Thailand has one of the most well-developed petrochemical industries in Asia. This article provides insights into past and present trends, challenges, and key success factors for the Thai chemical industry.

Thailand has a significant economic presence in Asia, with a gross domestic product (GDP) ranking in the region’s top ten. The country’s petrochemical industry, which accounts for about 5% of its GDP, has a long history of growth and development (1). This article offers insights into Thailand’s economic background, discusses the trends, policies, and challenges that impact the Thai chemical industry, and includes perspectives from industry executives and experts on its future prospects.

Thailand’s economy

With an estimated population of 69 million (2), Thailand has the second-largest economy in southeast Asia, behind Indonesia. Its GDP per capita of US$5,900 (3) places the country fourth in the region, behind Singapore, Brunei, and Malaysia.

▲Figure 1. Thailand has several major chemical and petrochemical industry complexes. The site located in Map Ta Phut (MTP) is one of the largest and best developed in Asia.

Relatively large domestic demand has enabled the petrochemical sector to capitalize on economies of scale. Thailand’s largest chemical and petrochemical complex is located about 200 km east of Bangkok in Map Ta Phut (MTP), in the Rayong province. It is one of the largest and best-developed petrochemical complexes in Asia (Figure 1).

After the 1973 and 1979 oil shocks, the Thai government decided to develop its domestic natural gas and petrochemical industries to reduce energy imports as well as the impact of global crude oil price fluctuations on Thai petrochemical product prices. The discovery of wet natural gas reserves in the Gulf of Thailand was another key driver for industry development. This gas contains sufficient C2+ molecules (ethane, propane, and butane) to be useful for both the petrochemical and fuel industries. In 1978, the Thai government founded the Petroleum Authority of Thailand (PTT) to advance the country’s natural gas and petrochemical industries.

Commercial natural gas production and underwater pipeline transportation from the Gulf of Thailand began in 1981. Thailand’s first proposed petrochemical complex, the National Petrochemical Complex Project-1 (NPC-I), relied on wet gas for C2+ feedstocks. Since that time, the gas-based petrochemical industry has contributed significantly to the Thai economy (4).

First petrochemical wave: 1980–1989 (NPC-I)

Thailand initially relied on imported raw materials and products despite decades of widespread petrochemical product use. During 1980–1989, domestic petrochemical production was driven by import substitution and the increasing value of indigenous natural gas.

At the time, the industry served a domestic market and investments were made through public- and private-sector cooperation. The feedstocks were gas-based ethane and propane, while products were basic commodities such as olefins and derivatives.

Second petrochemical wave: 1989–1995 (NPC-II) and 1995–2004 (liberalization)

When the petrochemical sector shifted its strategic focus from domestic consumption to exports, the government moved forward with NPC-II. The private sector participated directly in petrochemical and related manufacturing activities. Aromatics (Thailand) Co. (ATC) was established in 1989, and Thai Olefins Co. (TOC) was founded in 1990; both produced raw materials needed for intermediate and downstream industries. From 1989 to 1995, Thailand’s manufacturing base grew to replace imports for a wide product range. From 1995 to 2004, petrochemical companies began increasing exports as world economies expanded international trade. During this liberalization of trade, the industry attempted to strengthen its international marketing capabilities.

Third petrochemical wave: 2004–present

The Thai government has developed a master plan with a focus on increased competitiveness, asset integration, and strategic alliances. To achieve these goals, additional research is required for sophisticated product development in new grades of polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC). A close assesment of deeper downstream petrochemical value chains, including phenol, ethylene oxide and glycol, propylene oxide and glycol, polyols, and polyurethane products, is also necessary.

Higher demands for diversified intermediate and downstream petrochemical products have increasingly shifted the petrochemicals feed slate toward a higher proportion of liquid feedstocks.

Thailand’s three major petrochemical players are PTT Global Chemical (PTTGC), SCG Chemicals (SCGCH), and Integrated Refining and Petrochemical Complex (IRPC) (Table 1). PTT has been Thailand’s key national enterprise, and it became a publicly owned company in 2001.

| Table 1. Ten chemical companies and their affiliates produce the majority of Thailand’s petrochemicals. | ||

| Company | Major Affiliates | Key Products |

| PTT Global Chemical (PTTGC) | PTT Phenol, PTT Asahi, TOC Glycol | Ethylene, propylene, high-density polyethylene (HDPE), low-density polyethylene (LDPE), polypropylene (PP), mixed C4, butene, butadienes, benzene toulene xylene (BTX), cyclohexane, o-xylene, p-xylene, mixed xylenes, phenol, acetone, bisphenol-A, ethylene oxide (EO), ethylene glycol (EG), acrylonitrile, methyl methacrylate (MMA), toluene diisocyanate (TDI), polyurethanes |

| SCG Chemicals (SCGCh) | ROC, MOC, TPC, Siam Mitsui PTA, Thai MMA | Ethylene, propylene, HDPE, LDPE, PP, mixed C4, BTX, 1-ethyl-3-(3-dimethylamino-propyl) carbodiimide (EDC), vinyl chloride monomer (VCM), polyvinyl chloride (PVC), terephthalic acid (PTA), polyethylene terephthalate (PET), MMA, poly(methyl methacrylate) (PMMA) |

| IRPC | IRPC Polyol, IRPC A&L | Ethylene, propylene, HDPE, LDPE, PP, mixed C4, butadienes, BTX, acetylene, styrene, polystyrene |

| SCGCH-DOW | MTP, HPPO, SSMC | Styrene, polystyrene, synthetic latex, propylene oxides |

| Bangkok Synthetics (BST) | BST, BST Elastomers | Butene, butadienes, methyl tert-butyl ether (MTBE), butadiene rubber (BR), styrene-butadiene rubber (SBR), synthetic latex |

| Indorama Petrochemicals | Indorama (Polyester, Polymers, Ventures), PETFORM, TPT Petrochemical | PTA, PET, p-xylene |

| Vinythai | Vinythai (VNT) | EDC, VCM, PVC |

| UBE | UBE Chemicals Asia, UBE Fine Chemicals, Thai Synthetic Rubber | Caprolactam, ammonium sulfate, nylon and compound, fine chemicals (diphenol, lactam-related, C1 chemicals) |

| ExxonMobil | ExxonMobil Chemicals | p-xylene, hexane, rubber solvent, white spirit, aliphatic hydrocarbon solvent, plasticizers |

| Thaioil | Top Solvent | p-xylene, cyclohexane, hexane, BTX, solvents |

| Others | Teijin, Covestro, Bayer Thai, others | Polyesters, polycarbonates, polyurethanes |

PTTGC and IRPC are PTT Group subsidiaries, and SCGCH is subsidiary of Siam Cement Group (SCG). PTT owns five sets of cracker and downstream polymer production units, while SCG owns two sets.

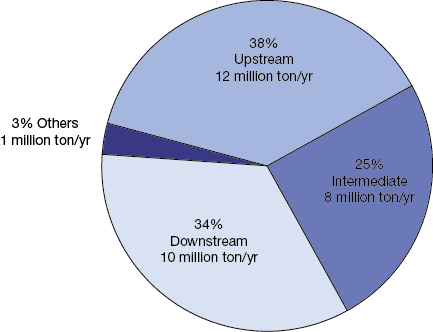

▲Figure 2. Upstream olefins, including ethylene and propylene, account for just over one-third of Thailand’s petrochemical capacity, while downstream products, such as polystyrene and nylon, represent another one- third. Intermediates and other chemicals, such as acrylonitrile and polyol, make up the balance of capacity. Source: (5).

Today, the Thai petrochemical industry is well-developed, and includes upstream, intermediate, and downstream petrochemicals. As of 2016, upstream olefins such as ethylene and propylene were produced in the largest volumes, with operating capacities of 4.44 million ton/yr and 2.85 million ton/yr respectively (Table 2, Figure 2).

| Table 2. Thailand’s major petrochemical products and their capacities. Source: (5). | |||

| Category | Product | Operating Capacity (thousand ton/yr) | Company Groups |

| Upstream Olefins | Ethylene | 4,436 | PTTGC, SCGCH, IRPC |

| Propylene | 2,847 | PTTGC, SCGCH, IRPC | |

| Butene-1 | 60 | SCGCH-BST, PTTGC | |

| Butadienes | 265 | SCGCH-BST, PTTGC, IRPC | |

| Upstream Aromatics | Benzene | 1,394 | PTTGC, SCGCH, IRPC |

| Toulene | 330 | PTTGC, SCGCH | |

| p-xylene | 2,303 | ExxonMobil, Thaioil, PTTGC, SCGCH | |

| o-xylene | 86 | PTTGC | |

| Mixed xylene | 328 | PTTGC, SCGCH, IRPC | |

| Intermediate Olefins | Acrylonitrile | 200 | PTT Group |

| Mono ethylene glycol (MEG) | 423 | PTT Group | |

| Ethylene oxide (EO) | 136 | PTT Group | |

| Epichlorohydrin | 115 | Adithaya Birla Group | |

| Methyl methacrylate (MMA) | 260 | SCGCH, PTT Group | |

| Vinyl chloride (VCM) | 990 | SCGCH-TPC, Vinythai | |

| Phenol | 450 | PTTGC | |

| Acetone | 278 | PTTGC | |

| Cumene | 594 | PTTGC | |

| Bisphenol A | 430 | PTTGC | |

| Propylene oxide (PO) | 430 | SCGCH | |

| Intermediate Aromatics | Cyclohexane | 200 | PTTGC |

| Caprolactam | 130 | UBE Group | |

| Styrene monomer (SM) | 540 | SCGCH-DOW, IRPC | |

| Purified terephthalic acid (PTA) | 2,787 | SCGCH, Indorama | |

| Downstream Olefins | Low-density polyethylene/ethylene-vinyl acetate (LDPE/EVA) | 558 | PTTGC, SCGCH, TPI Polene |

| Linear low-density polyethylene (LLDPE) | 1,390 | PTTGC, SCGCH | |

| High-density polyethylene (HDPE) | 1,900 | PTTGC, SCGCH, IRPC | |

| Polyvinyl chloride (PVC) | 846 | SCGCH-TPC, Vinytha | |

| Polypropylene (PP) | 2,005 | SCGCH, PTT Group, IRPC | |

| Polycarbonate | 460 | Covestro-TPCC | |

| Butadiene rubbers | 389 | SCGCH-BST, UBE | |

| Epoxy resins | 80 | Adhitaya Birla Group | |

| Downstream Aromatics | Polystyrene | 370 | SCGCH, IRPC, PTT Group |

| Expandable polystyrene | 48 | Ming Dhi Chemical | |

| ABS/SAN | 272 | IRPC, Styrosolution | |

| Nylon | 174 | UBE Group; Thai Toray | |

| PE terephthalate products | 1,807 | Indorama Group, Teijin | |

| Other Chemicals | Polyol | 245 | DOW, IRPC |

| Linear alkyl benzene (LAB) | 100 | PTT Group | |

| Propylene glycol | 150 | DOW | |

| Urea formaldehyde resin | 410 | Vanachai Chemical | |

| Ethanolamine | 50 | PTT Group | |

| Ethoxylate | 50 | PTT Group | |

| Methyl tertiary-butyl ether (MTBE) | 55 | SCGCH-BST | |

While the Thai petrochemical industry produces mainly standard commodity chemicals, the crude oil price spike of 2009–2010 sparked interest in fuels and chemicals produced through biomass or biochemical processes. This spurred research and commercialization that continues today.

Thailand has abundant biofeedstock resources, such as sugar cane, cassava, molasses, and other natural products. The Thai government aims to promote the production of chemicals derived from these biofeedstocks. The country also has one of the largest bioethanol industries in Asia, producing 322 million gallons in 2016, along with a strong palm-based biodiesel industry.

Upstream and downstream petrochemical businesses are often joint ventures between large Thai companies such as PTT Group or Siam Cement Group (SCG) and foreign chemical companies that provide licensed technologies. Fine and specialty chemical businesses are owned mainly by foreign companies.

Specialty plastics are imported for many industries, including the automotive and medical equipment industries. Value-added plastics are needed for specialized packaging sectors in the electronic and medical industries.

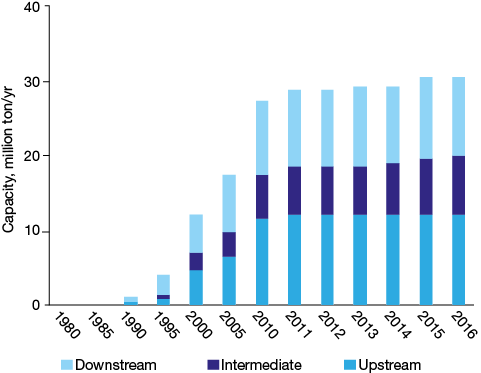

▲Figure 3. Thailand’s petrochemical capacity grew rapidly through 2010 and since then has remained relatively flat. Source: (5).

Figure 3 shows the growth in Thailand’s petrochemical capacity. After completion of new crackers in 2010, this capacity has remained relatively flat. At that time, environmental constraints began to limit the country’s ability to build or add new capacities in the overloaded MTP area.

Additional petrochemical capacity also exceeded domestic demands, prompting more exports to neighboring countries such as China, Thailand’s biggest export destination. China and the Middle East have also started to develop their own petrochemical industries, which may significantly impact Thailand’s industry.

Chemical imports and exports

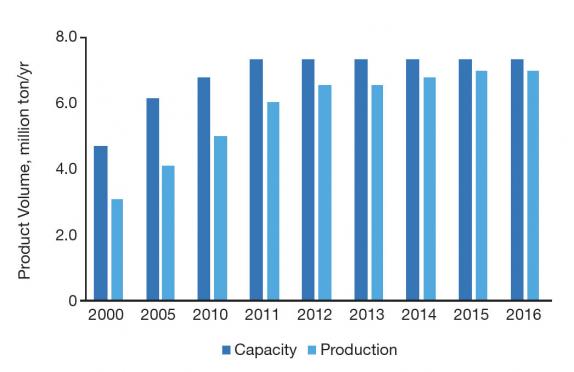

▲Figure 4. Capacity utilization has remained high since 2012 and Thailand continues to export about half of the petrochemicals produced (5).

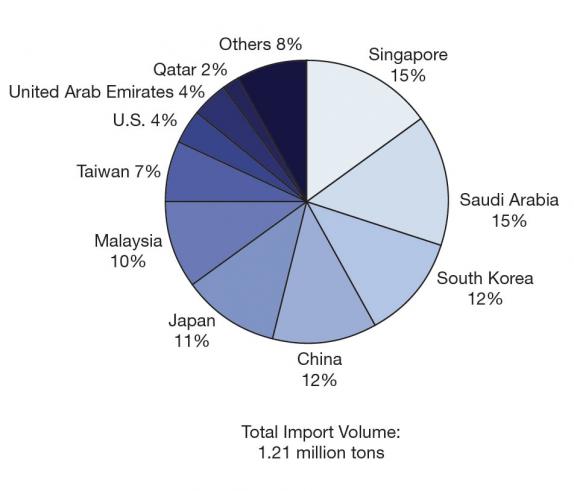

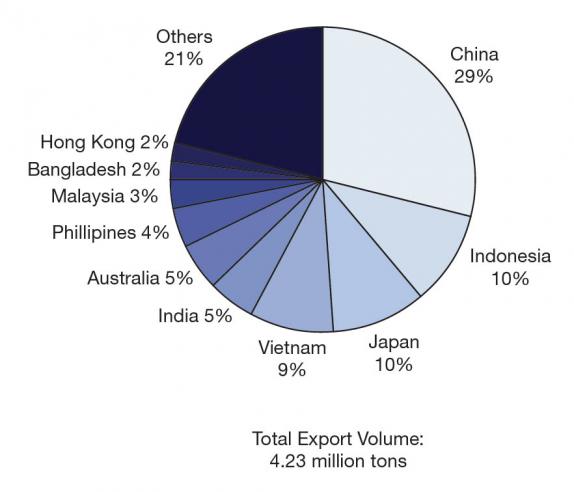

Thailand exports 50–60% of its total petrochemical production. In 2016, it exported 4.23 million ton/yr of major polymers (PE, PP, PS, acrylonitrile butadiene styrene/styrene acrylonitrile resin (ABS/SAN), and PVC), compared with imports of 1.21 million ton/yr (Figure 4). Capacity utilization has remained high, at 80–90%, for the past few years.

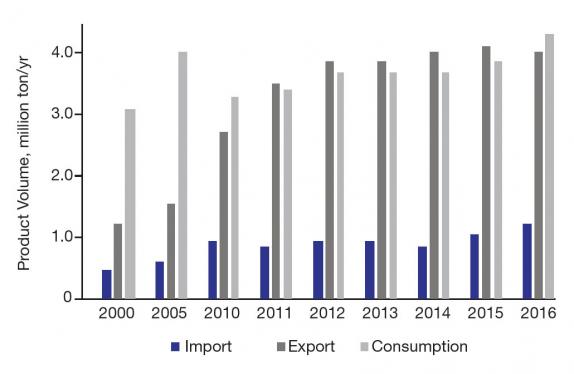

▲Figure 5. Singapore, Saudi Arabia, South Korea, and China provide the majority of Thailand’s chemical imports of polyethylene (PE), as well as polypropylene (PP) and polystyrene (PS). In 2016, over half of Thailand’s polymers exports went to China, Indonesia, Japan, and Vietnam. Source: (5).

Figure 5 shows that just over half of Thailand’s major polymers imports come from Singapore (15% of imports), Saudi Arabia (15%), South Korea (12%), and China (12%). Major export destinations (Figure 5) ranked by volume are China (29%), Indonesia (10%), Japan (10%), and Vietnam (9%).

Current trends, policies, and challenges

The Thai petrochemical industry had expanded significantly with new mega-plant projects starting in the 1990s and continuing through 2008.

Nevertheless, Thailand’s GDP per capita continues to stagnate in the middle-income range (US$4,000–10,000). To move the country out of this middle-income trap, the Thai government established “Thailand 4.0,” a 20-year economic development plan.

It aims to steer Thailand into a more innovative and science- and technology-based economy, with a goal to increase research and development investment from 0.6 % to 1% of GDP. R&D was previously funded mostly by the public sector; but, the private sector is stepping up and increasing its R&D investments to meet the national goal.

However, in December 2009, a Supreme Administrative Court ruling suspended or delayed 76 new MTP industrial projects because environmental and health concerns were not fully addressed during project planning.

Though this issue has been resolved, it has created more stringent environmental impact assessment (EIA) requirements and higher hurdles for building new petrochemical plants in the MTP area.

Thailand has limited access to low-cost petrochemical feedstocks. Therefore, it needs to strengthen its chemical industry through R&D and technological innovations.

Leading Thai petrochemical companies, including PTTGC, SCGCH, and IRPC, have increased R&D investments, from 0.3% to 1% of total sales.

SCGCH and PTTGC are endeavoring to reduce commodity chemicals production and increase production of high value-added (HVA) products, such as methyl methacrylate (MMA), propylene oxide (PO), and acrylonitrile. The Thai petrochemical industry is also facing other challenges, including:

- dwindling feedstocks as Gulf of Thailand natural gas reserves are depleted

- a lack of Thai-owned cutting-edge chemical and petrochemical technologies — scale-up from laboratory to plant remains a key R&D challenge

- environmental rules and saturated domestic demand that present large hurdles for building new plants.

Future prospects for the Thai petrochemical industry

The Thai petrochemical industry should continue to grow and benefit from stable crude oil and natural gas prices, which will ultimately also influence the industry’s future concerning:

- its limited ability to expand plant capacities

- environmental constraints that present hurdles for new players trying to enter the industry

- the Thailand 4.0 policy, which has identified biofuels and biochemicals as growth engines

- Thailand’s Eastern Economic Corridor (EEC), a special zone set up with unprecedented tax incentives (e.g., 15-year corporate income tax waivers) and non-tax benefits to attract additional foreign investments.

Stable crude oil and natural gas prices will also impact new plant capacity or expansions outside Thailand, namely the SCGCH Long Son Petrochemical Complex in Vietnam, SCGCH Chandra Asri olefin plant expansion, and PTTGC America’s project to tap shale gas in the Marcellus Basin in the U.S.

Views from industry experts

Three experts shared their views on the industry’s outlook, trends, and challenges.

Pailin Chuchottaworn was the CEO of PTT, Thailand’s national oil company, from 2011 to 2015. He believes a disruption from the electric vehicle (EV) industry may reduce future demand for Thai fossil fuels, causing exploration and refining companies to reduce fuels production capacity significantly.

Liquid fuels would no longer be the energy form of choice. Safer, autonomous driving technology should allow for the use of more plastics in automobile parts instead of steel. This prediction indicates that the petrochemical industry should remain healthy.

Chuchottaworn also acknowledges that Thailand needs to shift from commodity and copycat high-value-added petrochemical products into higher-value fine and specialty chemicals and plastic products to improve petrochemical gap margins.

Tevin Vongvanich, PTT’s CEO from 2015 to 2018, anticipates that Thailand 4.0 and EEC policies could help accelerate GDP growth and strengthen Thailand’s position as the geographical hub for continental Asia.

PTT petrochemical production will rely more on liquid feedstocks, and the company is increasing cracker feed flexibility to handle more liquid feeds. Thailand 4.0 is expected to generate new engineered plastic demands and applications.

Vongvanich notes that in 2011, PTT merged PTTAR with PTT Chem to form PTTGC, as part of its strategic plan to integrate the refinery and petrochemical businesses and expand into more specialty chemicals and materials.

Today, he sees EV and green plastics recycling technologies as the key technologies likely to impact the petrochemical industry. PTTGC recently invested in Natureworks for its PLA bioplastics, and in Perstorp (Vancorex) for its toluene di-isocyanate (TDI), which can be used to produce polyurethanes.

PTTGC is considering investing in the U.S. to gain access to shale gas as a cheaper petrochemical feedstock. He also believes that China, which has started its own petrochemical industry to become more self-sufficient, will increase competition for the country’s petrochemical industry exports to the regional market.

Suracha Udomsak is the current President of the Thai Institute of Chemical Engineering and Applied Chemistry (TIChE). He expects SCGCH to grow its petrochemical revenues by expanding to southeast Asian countries (e.g., Vietnam and Indonesia) and diversifying existing polymer product lines into new markets and new applications.

He also believes the Thai petrochemical industry will likely continue to perform well in the future due to growing plastic demands. However, he expects a more efficient recycling-based economy will be the key to sustainable development.

Closing thoughts

Faced with domestic and international challenges, Thailand’s petrochemical companies are seeking new opportunities abroad, including joint venture deals and mergers and acquisitions to extend and strengthen product and technology portfolios. With such plans underway, the country will continue to be a major petrochemical producer and exporter of petrochemical products for Asia.

Acknowledgments

The author thanks Prapai Numthavaj and Siri Jirapongphan of the Petroleum Institute of Thailand (PTIT) for extensive data support, as well as Pailin Chuchottaworn, Tevin Vongvanich, and Suracha Udomsak for their insights.

Literature Cited

- Petroleum Institute of Thailand, “From Banana Leaves to Plastic Bags: Development of Thai Petrochemical Industry,” http://www.ptit.org/index.php/Publications.Special/Special-Publications (2003).

- World Population Review, “Thailand Population 2018,” http://worldpopulationreview.com/countries/thailand-population (accessed Sept. 10, 2018).

- Trading Economics, “Thailand GDP per Capita,” https://tradingeconomics.com/thailand/gdp-per-capita (accessed Sept. 10, 2018).

- Bunsumpun, P., “Thailand’s Developing Natural Gas and Petrochemical Industry,” presented at GASTECH 2005, Bilbao, Spain (Mar. 16, 2005).

- Petroleum Institute of Thailand, “PTIT Focus, Special Annual Issue” (2016).

Copyright Permissions

Would you like to reuse content from CEP Magazine? It’s easy to request permission to reuse content. Simply click here to connect instantly to licensing services, where you can choose from a list of options regarding how you would like to reuse the desired content and complete the transaction.