Restructuring and investment underpin export growth in Hungary’s chemical industry. With continued investment in research and development projects, the country is on track to become a net exporter of chemical products.

▲Figure 1. Significant investments in Hungary’s chemical industry began in the 1970s and continued throughout the beginning of this century. Today, major chemical companies are located in Central Transdanubia, and Central and Northern Hungary.

Located in a relatively small geographic region in Central-Eastern Europe, landlocked Hungary (Figure 1) shares a common history with the Czech Republic, Poland, and Slovakia. All four countries belonged to the Eastern Block, as members of the Council for Mutual Economic Assistance (COMECON), established in 1949 under Moscow’s control. With COMECON’s demise in 1991, the four formed the Visegrád Group (V4), a cultural and political alliance to advance their European integration, and further military, economic, and energy cooperation (1). They all joined the European Union (EU) in 2004.

Hungary began to reform its economy more than three decades ago, first to move its economic system closer to a market economy, and then after 1990, to prepare for EU membership (2). The main purpose of Hungary’s development policy was to increase integration with the EU and the production of high-value-added products. The policy was centered on the EU market and development funds, as well as relatively lower production costs, and emphasized R&D for high-tech industrial sectors.

The country has an export-oriented economy driven by automobile, chemical, and pharmaceutical production. In 2014, Hungary exported $99 billion in goods and imported $92 billion, and had a trade surplus of $7.5 billion. Of its total exports, 78% headed to EU member states, while 75% of imports came from them. (Germany — Hungary’s largest trade partner — received 27% of 2014 exports.) The remaining 22% of Hungarian exports went to non-EU countries, while 25% of its imports were shipped from those countries. The most significant non-EU partners for exports are the U.S., which received $3.5 billion in Hungarian exports, and the Russian Federation, which received $2.5 billion.

This article provides an industry overview, then summarizes its history, the regional structure of production, and the country’s top chemical companies and key products.

Industry overview

Hungary’s economic transformation in the first half of the 1990s improved some economic sectors, kept others at their former levels, and shrank a few sectors. The Hungarian Oil and Gas Co. Plc, part of the MOL Group, is one company that benefited from the improving economy and has since become a major European player.

The chemical industry is the second-largest contributor to Hungary’s economy after automobile production, accounting for more than 14% of gross domestic product (GDP) every year since 2012. Although the value of chemical industry production is continuously increasing, its percentage of GDP has remained about the same (3). Sales of Hungarian chemicals and chemical products nearly doubled to $6 billion from 2009 to 2015, registering a growth rate above that of the EU’s chemical industry. Industry output, including oil refining, chemical and pharmaceutical production, and rubber and plastic products, reached 19.2% of Hungary’s total manufacturing production in 2015 (4).

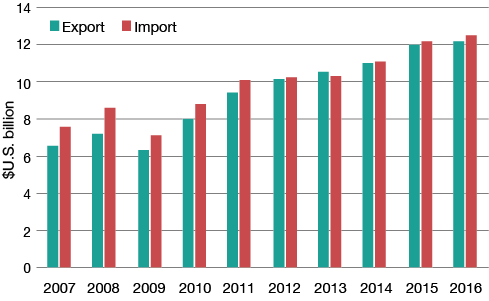

▲Figure 2. Since 2007, Hungary’s chemical exports to other EU countries have increased, and typically have tracked just below its imports from those countries.

Since 2007, three years after Hungary entered the EU, chemical exports to EU countries have increased steadily (Figure 2). The country is ranked 29th for chemical products exports and 33rd for chemicals imports, among 140 reporting countries (5). With substantial national and EU funds applied to chemical industry research and R&D projects, Hungary is expected to become a net exporter of chemical products in the coming years.

Pre-World War II (1900–1939)

Hungary’s chemical industries started developing in the decades before World War I. The pharmaceutical and fertilizer industries were the main sectors at that time. However, their expansion was limited by coal and raw material shortages. The situation worsened when Hungary lost two-thirds of its territory and a significant portion of its consumer market in the Trianon Peace Treaty of 1920. That treaty also had a negative impact on the country’s infrastructure and caused the loss of important raw material sources and processing facilities. Economic recovery and reorganization was difficult for Hungary during the 1920s, and was followed by the global economic crisis between 1929 and 1933. At that time, however, the chemical industry introduced new products and increased military supplies. By 1938, the industry was capable of satisfying the country’s domestic industries and agriculture demands. Mineral oil, pharmaceuticals, domestic synthetic rubber, and industrial gas production were also developing rapidly, and up to 30% of products were exported.

During World War II, the chemical industry’s production capacity was reduced to nearly one-third of prewar levels. By 1949, after massive reconstruction efforts, production value grew to exceed pre-World War II levels.

Post-World War II (1945–1970)

Chemical industry development accelerated after World War II. Between 1950 and 1955, the industry’s structure was modernized, and production doubled. Development followed global trends, with projects using locally sourced coal as a raw material base. At the end of the 1950s, large investments were made to build new fertilizer plants in Hungary’s Northeastern region, establishing three important chemical companies: the BVK (Borsodi Vegyi Kombinát), the TVK (Tiszai Vegyi Kombinát), and the TVM (Tiszamenti Vegyiművek). Petrochemicals became the focus of development by the beginning of the 1960s. Between 1961 and 1965, about 40% of investments focused on the fertilizer industry. Plastics production also received significant investments. By the close of the 1970s, Hungary’s chemical industry production volume was close to the international average.

Late 20th century (1971–2000)

In the 1970s, COMECON launched a program to integrate petrochemical production into the Hungarian chemical industry. The developing petrochemical industries, in turn, boosted overall industry growth at an 8.8% annual average over the decade. Petrochemicals became, and remain, the main chemical products exported.

The Hungarian government approved the Petrochemicals Central Development Program in 1973 (6). This program invested in several chemical plants, including BVK’s polyvinyl chloride (PVC) plant, TVK’s olefin operations, a poly-acrylnitrile plant at Magyar Viscosa Works, and ammonia and fertilizer plants at Péti Nitrogénművek. The program also started the country’s synthetic fiber production, which has made Hungary a leading European carbon fiber manufacturer.

By 1989, 18 additional chemical plants had been built. The plastics industry in Hungary also developed, producing plastic raw materials and plastic products. However, chemical industry production started declining during the 1990s, due to the transformation of the Hungarian economy and the reorganization of its agriculture. The fertilizers and plant protection chemicals sectors recorded the largest loss in the chemical industry as demand dropped sharply. The crude oil processing sector experienced a smaller decline because it configured its oil refineries to supply fuel for the growing road transportation sector. The plastic raw materials sector had ups and downs, but by the end of the 1990s production surpassed that of other EU countries, and 60% of its products were exported. The privatization of state-owned companies also started in this decade and ended in 1998. By that time, multinational companies owned most of the country’s top chemical companies. One exception was MOL, a Hungarian-owned company that has become multinational.

Beginning of the 21st century (2001–2007)

The chemical industry continued to grow as market demands increased and more investments were made for capacity expansions. After joining the EU, Hungary positioned itself to become the second-largest machinery manufacturer, which required more chemical supplies. This investment increment was huge since prior to joining EU, the domestic weight of the Hungarian chemical industry was lower than the EU average. During this time period, investment was focused on a crude-oil refinery, pharmaceutical and raw plastic materials, plastics processing, and rubber industries. MOL, TVK, BorsodChem, and Nitrogénművek received significant shares of the investments.

The Hungarian chemical industry had above-average efficiency and profitability compared to other EU countries. However, environmental protection practices were below the standard set by EU regulations, leading to higher environmental risk and impact. Complying with EU environmental regulations required additional financial and administrative efforts from Hungary’s chemical companies. Joining the EU also opened the Hungarian chemical industries to globalization, increasing the quality of the workforce and new technologies.

Recent years (2008–2017)

The 2008 financial and economic crisis hit the Hungarian economy hard. During the second half of 2008, sales of intermediate products for automotive electronics dropped, hurting Hungary’s chemicals and plastics suppliers. To cope with this crisis, chemical companies implemented immediate cost reduction, energy efficiency, and process improvement measures for their technical and commercial programs. The product portfolio was restructured and oriented to products less prone to recession, such as gasoline and petrochemicals. From 2010 onward, the chemical industry has slowly increased production.

Production statistics

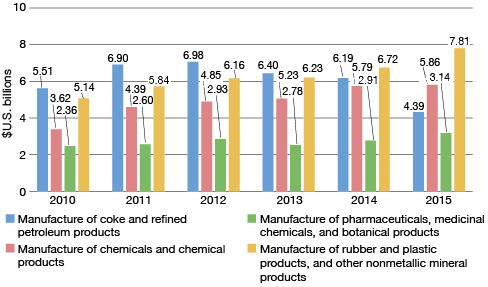

▲Figure 3. Revenues from Hungary’s chemical industry, including petroleum, chemical, pharmaceutical, and plastics manufacture, have been affected by global economics, including the 2013 Eurozone crisis.

Recovery from the economic crisis began in 2009. By 2010, chemical production was growing at a healthy rate until 2013, when the industry was hit by the Eurozone crisis. Growth resumed at a slow pace in 2014, approaching $22 billion in trade. Figure 3 shows 2010–2015 revenue trends.

Table 1 presents a breakdown of 2015 chemical production by subsector. Overall chemicals, which include fertilizers and organic and inorganic chemicals among other products, account for 31% of production value. Rubber and plastic products represent 29% of value, which is related to Hungary’s position as a leading provider of automobile parts. Oil processing and coke (23%) and pharmaceuticals (17%) account for the remaining production value.

| Table 1. Hungary’s chemical subsectors accounted for $19 billion in production value in 2015. | |

| Chemical Subsector | Production Value, $U.S. million |

|---|---|

| General chemicals | 5,852 |

| Rubber and plastic products | 5,570 |

| Oil processing, cokes | 4,407 |

| Primary-form plastics | 3,775 |

| Pharmaceuticals | 3,162 |

| Detergents | 428 |

| Organic basic chemicals | 412 |

| Fertilizers, nitrogen compounds | 314 |

| Industrial gases | 226 |

| Other chemical products | 225 |

| Paints, varnishes | 140 |

| Inorganic basic chemicals | 134 |

| Agricultural chemicals | 81 |

| Perfumes, personal care products | 60 |

| Dyes and pigments | 29 |

| Essential oils | 12 |

| Explosives | 10 |

| Glues | 5 |

▲Figure 4. The Hungarian chemical industry is a significant employer in several regions of the country, employing 124,600 individuals by 2014 across plastics, pharmaceuticals, overall chemicals, and oil production.

The chemical industries employed roughly 120,000 people from 2010 to 2014. Rubber and plastic products manufacturing employ the largest number of people (Figure 4).

Regional structure of the chemicals Industry

Important chemical industry clusters can be found in Northern Hungary, Central Hungary (Budapest and the surrounding area), and Central Transdanubia.

The Northern Hungary region’s high concentration of raw materials, such as iron, was the basis for development of the country’s machinery industry. By the 1970s, under the COMECON umbrella, Northern Hungary had become the center of heavy industry. Today, the region accounts for 49% of the country’s total industrial output (7). The COMECON program has since switched its focus to petrochemical and polymer production, and today there are 25 industrial parks providing up-to-date infrastructure for small and medium enterprises. The region now accounts for 15% of Hungary’s chemical sales (6).

Central Hungary around Budapest is the country’s economic, commercial, financial, administrative, and cultural center (7). As Hungary’s most developed region, it generates approximately half of the GDP. The region also accounts for half of Hungarian chemical sales, with oil refineries and production facilities for petrochemicals and polymers, specialty and fine chemicals, and pharmaceuticals (6). MOL, the largest oil company in Hungary today, has its central office and refineries in the region.

Budapest has an international airport and a well-developed infrastructure that enables efficient goods distribution. This has helped attract foreign investment and, as a result, the surrounding area has become the starting ground for high-tech small and medium enterprises.

Central Transdanubia has a robust machinery industry and represents 8% of the country’s chemical sales (6). It is the fastest developing region economically, boasting a strategic location and a highly qualified labor force. Central Transdanubia also has half of the country’s brown-coal deposits; however, the mining sector is slowly declining because reserves are located in hard-to-reach areas. The presence of the Danube River provides opportunities for industries that use process water, such as metallurgy, food processing, machinery, and chemicals. The region’s chemical industry is focused on fertilizers, carbon fibers, and agricultural chemicals.

Hungary’s top chemical companies

TVK/MOL Group. MOL was founded in 1991, as the legal successor of Hungarian Oil and Gas Trust (OKGT) (8). Headquartered in Budapest, MOL Group operates in several European and Asian countries. MOL Group is comprised of MOL, the largest enterprise in Hungary; Slovnaft, the Slovak Oil and Petrochemical Co.; TVK, Hungary’s leading petrochemical company; and other European refining and retail companies.

MOL has nearly 1,000 filling stations and exploration and production facilities in eight countries in Europe, the Middle East, Africa, and the Commonwealth of Independent States (CIS). It has upstream, downstream, petrochemical, and gas transmission operations in over 40 countries, and is the market leader in each of its core activities in Hungary and Slovakia.

The MOL Group produced Europe’s fastest growth in shareholder return in the past ten years, ahead of all its major industry peers on the continent, excluding Russian Federation companies. MOL employs 15,000 people worldwide and has market capitalization around $16 billion.

While focused on financial and business results, MOL has made significant advances in its social and environmental performance and corporate governance and is fully committed to sustainable development. It was among the first European companies to produce sulfur-free motor fuels, blend biofuel, and advance the introduction of geothermal energy, thus reducing Hungary’s greenhouse gas footprint.

MOL serves more than half of the Hungarian market, and has twice as many service stations in Hungary than in Romania. Many of its products are exported to European countries such as Slovakia and Croatia. MOL has refinery and petrochemical sites located in Százhalombatta, Tiszaújváros, and Zalaegerszeg.

The construction of the chemical complex at Tisza (TVK) began in the 1950s by order of the National Planning Institute. In 1999, MOL began purchasing TVK shares and, in 2015, MOL Plc. became the owner of TVK, resulting in a name change to MOL Petrochemicals Zrt.

BorsodChem/Wanhua Group. Borsodi Vegyi Kombinát (BVK) was established in 1949 as a synthetic-fertilizer producer. Following a series of mergers in 1963, BVK started the first PVC plant in Hungary. After adding methylene diphenyl diisocyanate (MDI) production, the company became known as BorsodChem (9). It expanded into neighboring European countries by acquiring companies such as Petrochemia-Blachownia S.A. in Poland and Moravské Chemické Závody (MCHZ) in the Czech Republic. Currently, BorsodChem has a strong relationship with its strategic investor, Wanhua Industrial Corp. of China. Headquartered in Hungary, BVK has subsidiaries and branch offices in Belgium, Croatia, Czech Republic, Italy, Poland, and the U.K. BVK offers a range of products, including polyurethane, MDI, toluene diisocyanate (TDI), and PVC. Its production facility in Kazincbarcika is one of the leading European producers of MDI, TDI, PVC resin, and chloralkali chemicals.

Nitrogénművek/Bige Group. A potassium nitrate plant was approved in 1928 and built in Pétfürdő. It had a strategic location for fertilizer production near Várpalota’s lignite supply, Bakony’s lime supply, and the water supply from the Séd stream. Over the decades, the plant went through expansions and contractions, especially during World War II. Ownership was passed along to several companies until 1990, when Nitrogénművek Rt was founded. Nitrogénművek Rt then consolidated its debt and invested in technology and reducing energy consumption (10). Today, it is owned by Bige Holding Investment and Venture Ltd., which is controlled by László Bige, one of Hungary’s richest men. Nitrogénművek is the only Hungarian fertilizer plant that produces and uses its own raw materials. It is also the only nitrogen-based fertilizer producer in Hungary, with about 60% share of the Hungarian market.

Closing thoughts

Although the Central-Eastern European region was damaged and partially destroyed during the 20th century, Hungary has recovered, and over a short time, its chemical industry has become competitive and a significant contributor to the nation’s GDP. Contributing to the industry’s success are its strategic geographic location, qualified and educated workforce, forward-thinking R&D policy, growing economy, and substantial investments made by multi-national companies.

Literature Cited

- Visegrád Group, “The Bratislava Declaration of the Prime Ministers of the Czech Republic, the Republic of Hungary, the Republic of Poland and the Slovak Republic on the Occasion of the 20th Anniversary of the Visegrad Group,” www.visegradgroup.eu/2011/the-bratislava (Feb. 2011).

- Csizmadia, L., “The Transition Economy of Hungary Between 1990 and 2004,” http://pure.au.dk/portal/files/2620/Csizmadia-Thesis.pdf (June 2008).

- KOPINT-TÁRKI, “A Magyar Vegyipar Helyzete,” www.mavesz.hu/wp-content/uploads/2016/02/Kopint-tanulma%CC%81ny-A4-2016nov_full-page.pdf (Nov. 2016).

- The European Chemical Industry Council, “Landscape of the European Chemical Industry 2017, Hungary,” CEFIC, Brussels, Belgium, www.chemlandscape.cefic.org/country/hungary (accessed Aug. 2017).

- United Nations, U.N. Commodity Trade Statistics Database, https://comtrade.un.org (accessed Dec. 2015).

- MAVESZ, “Chemical Industry in Hungary: 25th-Anniversary Publication of the Hungarian Chemical Industry Association,” www.mavesz.hu/index.php/en (accessed Dec. 2015).

- European Commission, “Magyarorszag — International Market, Industry, Entrepreneurship and SMEs,” ec.europa.eu/growth/tools-databases/regional-innovation-monitor/region/magyarorszag (accessed Dec. 2015).

- MOL Group, “Our History,” molgroup.info/en/about-mol-group/our-history (Dec. 2016).

- BorsodChem, “Chemistry for Generations,” www.borsodchem-group.com/Documents/Brochures/corporateBrochure.aspx (accessed Dec. 2016).

- Nitrogénművek Zrt, “History: The 80 Years of Nitrogénművek,” www.nitrogen.hu/nat/index.php?option=com_content&view=category&layout=blog&id=22&Itemid=76&lang=en (accessed Dec. 2016).

Copyright Permissions

Would you like to reuse content from CEP Magazine? It’s easy to request permission to reuse content. Simply click here to connect instantly to licensing services, where you can choose from a list of options regarding how you would like to reuse the desired content and complete the transaction.