The Philippine chemical industry is highly diverse and has the potential for significant growth. Industry-government partnerships and regional cooperation can help the country to become a leading chemical exporter.

The Philippine chemical industry is one of the country’s largest manufacturing sectors and supplies products used in many other sectors including agriculture/agribusiness, electronics, food processing, healthcare, national defense, and packaging (1). The industry’s primary aim is to transform the country’s rich natural resources into higher-value products that meet the needs of domestic and global markets (2).

This article discusses the economic impact, history, and current state of the chemical industry in the Philippines. It also outlines the industry’s future challenges and opportunities.

Economics

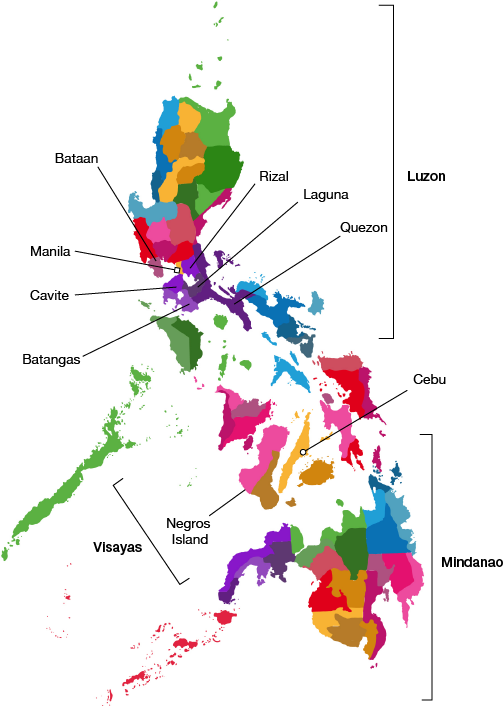

▲Figure 1. The Philippines is located between the Philippine Sea and the South China Sea and is comprised of eighteen regions. The majority of its chemical processing facilities are located in the Cavite, Laguna, Batangas, Bataan, Rizal, and Quezon provinces.

Located in Southeast Asia, the Philippines is comprised of about 7,200 islands with three major geographic divisions (Figure 1). Luzon is the largest and northernmost grouping. It is home to the capital city of Manila, as well as many chemical processing facilities. Visayas, in the center, is anchored by the booming city of Cebu. Mindanao, located in the southwest, is the Philippines’ agricultural center. Filipino is the official language across the country, but English is spoken in government and business transactions.

Despite the expansion of the Philippine service sector, manufacturing remains its economic engine. The chemical industry is the third largest manufacturing subsector (11% share of total manufacturing value added [MVA]); behind radio, TV, and communication equipment (17% MVA); and food manufacturing (36% MVA) (3). In 2015, industry revenues were $7.6 billion, an increase of 7% from 2010. As many as 1,405 chemical companies operate in the country (4), including local companies such as Petron Corp. and Chemrez Technologies, and multinational companies, such as Dow Chemical, DuPont, and 3M (Table 1).

| Table 1. Local and multinational chemical industry companies operate in the Philippines (1). | |

| Filipino Companies | Multinational Companies |

| Petron Corp. JG Summit Chemrez Technologies Mabuhay Vinyl Corp. RI Chemical Corp. United Coconut Chemicals, Inc. Pacific Paint (Boysen) Philippines, Inc. Atlas Fertilizer Corp. Philippine Phosphate Fertilizer Corp. Republic Chemical Industries, Inc. Charter Chemical & Coating Corp. | Dow Chemical Pacific Ltd. Dupont Far East Philippines, Inc. Bayer Air Liquide Philippines. Inc. Linde Philippines, Inc. Syngenta Philippines, Inc. Monsanto Philippines, Inc. Sojitz Philippines Corp. Ecolab Philippines, Inc. Tosoh Polyvin Corp. WR Grace Philippines, Inc. Pilipinas Kao Stepan Philippines, Inc. 3M Philippines, Inc. NALCO Philippines, Inc. Orica Philippines, Inc. |

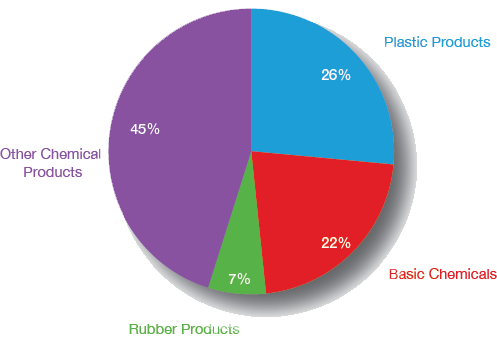

▲Figure 2. The Philippine chemical industry is highly diverse. Chemical products, including fertilizers, paints, and soaps, account for a large share of the country’s manufacturing industry (7, 8).

The industry is highly diverse, with over 46,000 chemicals registered in the Philippine Inventory of Chemical and Chemical Substances (PICCS) (5). Figure 2 breaks down the chemical industry by production share. Fertilizers, perfumes, drugs, and paints are some of the products categorized as other chemical products and account for 45% of the market. Plastic products make up 26% of production, and the basic chemicals sector, which includes alcohols, industrial gases, and resins, represents 22%. The remaining 7% is comprised of a variety of rubber products, including tires and industrial products.

Historical overview

Compania Cellulosa de Filipinas established the first Philippine chemical processing facility on Negros Island in 1941. This small electrolytic soda-chlorine facility was destroyed during World War II, but was rebuilt and reopened in 1949. That year, the Philippine government instituted import and foreign exchange controls in response to an economic crisis. These restrictions stimulated the local manufacturing sector and, from 1949 to 1961, several chemical production facilities were built. Three of the new plants produced caustic soda and chlorine, two manufactured sulfuric acid, and four produced phosphoric acid, liquid ammonia, ammonium sulfate, and calcium carbide. Two salt manufacturing facilities began operation at this time.

During the 1950s, tax exemption privileges granted under the New and Necessary Industries Law (Republic Act 901) encouraged the development of the chemicals industry. However, growth declined later in the decade when this law was terminated and import controls were lifted. The industry recovered when the exchange rate and prices stabilized and tax incentives were put in place with the revision of the Basic Industries Law (Republic Act 3127), instituted on June 17, 1961. Existing fertilizer plants were expanded and new production facilities commissioned for plastics, fertilizers, adhesives, and other chemicals.

Today, due to a strong demand for chemicals, the industry is expanding its trade agreements. The country has imported more than $7 billion in chemicals at a 13% average growth rate in the past five years (4). Chemical imports and domestic production represent approximately $14 billion, equivalent to 6.7% of the country’s gross domestic product (GDP) (2). Philippine chemical exports, on the other hand, are close to $3.5 billion, with an average annual growth of 17% from 2010 to 2015. The Philippines exports chemicals to 177 countries (4), with Japan and China as top destinations (6).

Factors influencing the industry

The Philippines has the youngest and fastest growing population in Southeast Asia, with a median age of 23. Filipinos are not only a strong labor force, they are a sizable consumer base for organic, pharmaceutical, personal care, and other chemical products. The country also benefits from abundant natural resources, including minerals and agricultural products, which serve as low-cost raw materials for the chemical processing industries (CPI).

The pioneering industry organization, Chemical Industries Association of the Philippines (Samahan sa Pilipinas ng mga Industriyang Kimika, commonly referred to as SPIK), was started in 1977 to strengthen the industry’s representation in government and private and international markets. SPIK promotes research and development of coconut-based chemicals and other oleochemicals through interfirm partnerships. It also supports the industry’s small- and mediumscale enterprises through technology transfer from large-scale companies, particularly those engaged in consumer products manufacturing.

The Philippine government supports the industry’s research initiatives via the Dept. of Science and Technology (DOST), Industrial Technology Development Institute (ITDI), and Philippine Council for Industry, Energy and Emerging Technology Research and Development (PCIEERD). These agencies partner with private organizations for joint research projects.

The government encourages investments in chemical manufacturing through the Investment Priorities Plan (IPP), which is a list of preferred investment areas eligible for government incentives. The current IPP lists research and development, research and testing laboratories, and the production of oleochemicals, petrochemicals and derivatives, and chlor-alkali products as priority areas.

In this auspicious environment, JG Summit Olefins Corp. (JGSOC) started up the first naphtha cracker plant in the Philippines on Nov. 1, 2014. The polymer-grade ethylene and propylene manufactured at this facility are used by downstream plants to produce polyethylene (PE) and polypropylene (PP) resins for both domestic and export markets. JGSOC also exports pyrolysis gasoline (pygas) (2).

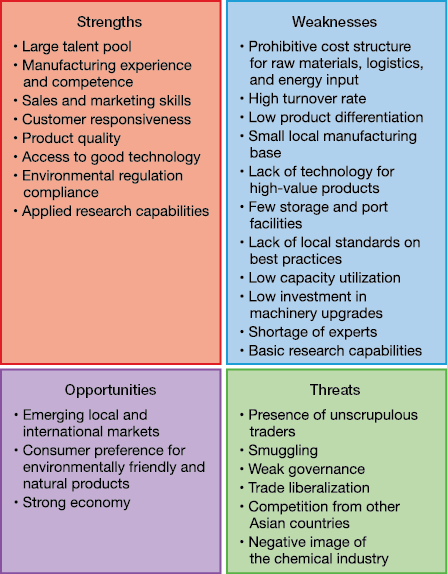

The country does have weaknesses to address. The Philippines has a prohibitive cost structure related to logistics, energy, and any raw materials not derived from its natural resources. The country’s small manufacturing base has low capacity utilization and low investment rates in machinery upgrades. Outdated storage and port facilities also hamper growth and contribute to higher costs. Many products are already commoditized, and local technology has not been developed to manufacture more higher-value products. Further, many Filipino workers migrate overseas for better wages and benefits, leading to a shortage of tech-nology experts. This affects basic research capabilities in the country.

▲Figure 3. A review of the strengths, weaknesses, opportunities, and threats associated with the Philippine chemical industry highlights benefits, such as a strong economy and large labor force, yet also indicates serious challenges, such as weak governance and prohibitive costs (4).

The chemical industry must also address several threats to growth. It struggles with its public image and must be proactive in countering consumers’ negative perceptions. It has to work closely with concerned government agencies to prevent chemical smuggling and stop unscrupulous traders who engage in illegal trade practices and sell substandard products. Close collaboration with the government is also imperative to shore up weak governance, minimize the negative effect of trade liberalization, and address competition from other Asian countries. Figure 3 summarizes the strengths, weaknesses, opportunities, and threats facing the Philippine chemical industry.

Responsible Care: A sustainability initiative

SPIK backs Responsible Care, a worldwide voluntary initiative that commits the chemical industry to protecting the environment and ensuring the health, safety, and security of its stakeholders. The initiative was introduced to the Philippines in 1994 by leading multinational companies with local manufacturing operations. It was adopted by SPIK and granted a charter by the International Council of Chemical Associations (ICCA) in 1996. The SPIK Responsible Care Council (SRCC) is mandated to coordinate the initiative’s promotion and monitor its implementation among company signatories (9). As an active participant in the Asia Pacific Responsible Care Conference, SPIK releases Responsible Care updates in its annual report.

Looking ahead

As part of the Philippine Chemical Industry Masterplan 2012–2030, the industry aims to establish itself as a leading exporter by 2022, and by 2030, secure a stronger foothold in the global chemical market (2). The industry plans to work with the Philippine government to set legislative policies based on sound technical and scientific studies and account for the system in which the chemical industry operates. The two entities will also collaborate to create a chemical industry cluster to enable production cost-efficiencies and improve export capabilities, as well as to develop an Engineering and Science Advanced Technology Program (EnSAT) to build Filipinos’ technical and scientific skills.

The Association of Southeast Asian Nations (ASEAN) is a major global hub of trade and manufacturing and one of the fastest growing consumer markets. As part of ASEAN-4 (Indonesia, Malaysia, Philippines, and Thailand), the Philippine chemical industry has the opportunity to strengthen its regional ties, improve efficiencies, and diversify (4).

The industry became poised for uninterrupted growth after the Implementing Rules and Regulations (IRR) on controlled chemicals was approved in 2016. An IRR is an evidence-based policy that supports industry development through streamlining and rationalizing processes, thereby making it easier to conduct business. This IRR reduced the number of controlled chemicals from 101 to 32, 15 of which are considered high risk and 17 low risk. The IRR also abolished police escort fees, and streamlined permitting and licensing procedures, reducing approval time from 20 days to 10 days. The IRR also abolished the accreditation requirement for logistics providers (10).

SPIK is playing a key role in industry growth by forging partnerships with educational institutions and government agencies. It partnered with the Technical Education and Skills Development Authority (TESDA) for process operator and quality assurance/quality control (QA/QC) laboratory technician training, and started internships for Univ. of the Philippines Engineering Research and Development for Technology (UP ERDT) scholars. SPIK collaborated with the U.S. Agency for International Development (USAID) in crafting the Science, Technology, Research and Innovation for Development R&D Roadmap and participated in research roundtable discussions. It plans to run inbound and outbound trade and investment missions. The association continually monitors members’ compliance with safety, health, and environmental regulations and standards, particularly on chemical certification stipulated in the Philippine Standard (PS) Quality and/or Safety Certification Mark Scheme (2). It also works with the Dept. of Trade and Industry Board of Investment (DTI-BOI) and other government regulatory agencies to ensure enabling policies for trade facilitation, competitiveness, and growth (4).

Literature Cited

- Samahan sa Pilipinas ng mga Industriyang Kimika, “The Philippine Chemical Industry,” http://spik.com.ph/chemical-industries (accessed Nov. 24, 2016).

- Dept. of Trade and Industry and Board of Investment, “Securing the Future of Philippine Industries: Chemicals,” www.industry.gov.ph/industry/chemicals (accessed Nov. 25, 2016).

- Batungbacal, B., “What Are the Fastest Growing Manufacturing Sub-Sectors in 2014?” Philippine Manufacturing Revisited,www.philippinemanufacturing.wordpress.com/2015/03 (accessed Jan. 28, 2017).

- Marcalain, J. G., “Innovative Technologies in Chemical Industries and Trends,” http://pcieerd.dost.gov.ph/images/downloads/presentation_materials/pcieerd5thanniv/03_Innovative_Technologies_in_Chemical_Industries_and_Trends_Marcalain.pdf (accessed Dec. 2, 2016).

- ChemSafetyPRO, “Philippine PICCS: The Philippine Inventory of Chemicals and Chemical Substances,” www.chemsafetypro.com/Topics/Philippine/PICCS_Philippine_Inventory_of_Chemicals_and_Chemical_Substances.html (accessed Sept. 26, 2017).

- World Integrated Trade Solution, “Philippines Chemicals Exports by Country 2015,” http://wits.worldbank.org/CountryProfile/en/Country/PHL/Year/2015/TradeFlow/Export/Partner/BY-COUNTRY/Product/28-38_Chemicals (accessed Jan. 30, 2017).

- Philippine Statistics Authority, “2014 Annual Survey of Philippine Business and Industry — Manufacturing Sector for Establishments with Total Employment of 20 and Over: Preliminary Results,” http://psa.gov.ph/content/2014-annual-survey-philippine-business-and-industry-aspbi-manufacturing-sector (accessed Feb. 6, 2017).

- Olaňo, S., “The Development of Chemical Industries in the Philippines,” ASEAN Journal of Chemical Engineering,1 (1), pp. 23–37 (2001).

- Samahan sa Pilipinas ng mga Industriyang Kimika, “Responsible Care,” http://spik.com.ph/responsible-care (accessed Nov. 24, 2016).

- Mercurio, R., “Philippine Chemical Industry Poised for Uninterrupted Growth,” The Philippine Star,www.philstar.com/business-usual/2016/06/20/1594518/philippine-chemical-industry-poised-uninterrupted-growth (June 20, 2016).

Acknowledgments

The author thanks the Chemical Industries Association of the Philippines (SPIK), the Dept. of Trade and Industry Board of Investments, the Philippine Statistics Authority, and the ASEAN Journal of Chemical Engineering editorial board for providing valuable information for this article.

Copyright Permissions

Would you like to reuse content from CEP Magazine? It’s easy to request permission to reuse content. Simply click here to connect instantly to licensing services, where you can choose from a list of options regarding how you would like to reuse the desired content and complete the transaction.